All Categories

Featured

Table of Contents

And they are likely to have the monetary ability to understand a high-risk investment opportunity, despite limited information.

The Securities Act calls for that all deals and sales of safety and securities need to either be signed up with the SEC or fall within an exception from registration - accredited investor philippines. The meaning of accredited investor in Guideline D of the Stocks Act establishes forth multiple groups of exceptions planned to demonstrate that certifying investors have sufficient financial sophistication such that the Securities Act's enrollment procedure and related protections are unneeded

Based primarily on a testimonial of filings made about Law D exceptions, the personnel report provides information on the number of U.S. families that satisfy the definition of certified capitalist and examines whether existing safety and securities market practices are giving adequate capitalist defense. The record states that 1,510,000 households (or 1.8% of all United state

households) by 2022. The considerable rise is attributed mainly to the truth that revenue and total assets limits under the interpretation have not been adapted to show rising cost of living, raising problems that rising cost of living and other economic aspects are blowing up the recognized financier swimming pool while financiers might not be as sophisticated as their big assets would appear to show.

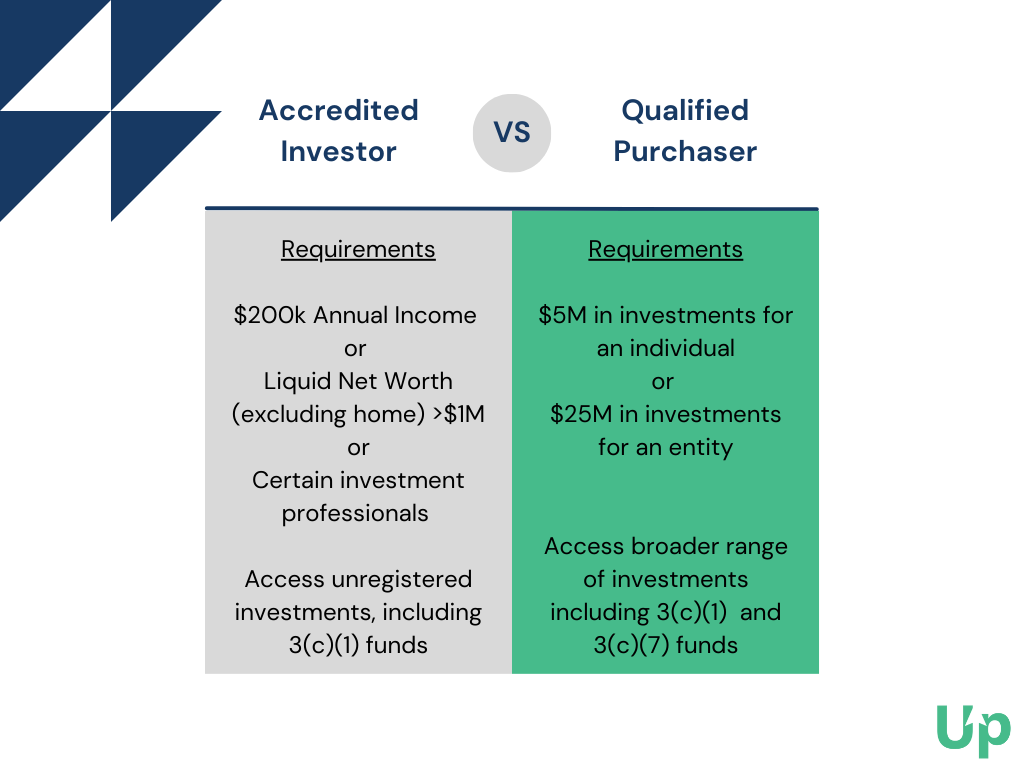

It aids ensure that those diving right into complex investments have the needed resources and understanding to handle them properly. Take the time to discover this designationit might be your portal to smarter, much more diversified investing. Approved financier status is defined by the SEC as an individual or entity with the monetary security and sophistication to buy unregistered protections financial investments, and can be gotten by conference income, net well worth or expert requirements.

Real Estate Crowdfunding Investments For Accredited Investors

Tabulation The Securities and Exchange Commission (SEC) defines an accredited financier as a specific or entity able to get involved in investments not registered with the SEC, usually booked for high-net-worth individuals or entities. This term, coined under Guideline D of the Securities Act of 1933, is created to ensure that just skilled investors with ample resources purchase these offerings.

Just how do you become a certified investor? To be taken into consideration, certain monetary or professional standards have to be met (accredited capital exchange). However what are these standards, and just how can you certify? Allow's dig a little deeper. Becoming a certified capitalist is not practically having a high income or huge quantity of wide range.

Subtract your overall liabilities from your complete properties. If the number meets the above limits, you're taken into consideration a certified capitalist. Entities like financial institutions, partnerships, companies, not-for-profit companies, and trust funds can additionally certify as accredited financiers, offered they meet property thresholds or all equity proprietors are approved capitalists themselves. Surprisingly enough, according to the SEC, since 2022 approximately 18.5% people homes certified as recognized financiers under the existing web well worth or revenue thresholds.

There have been ideas to add an experience requirement to these economic credentials, indicating the developing nature of the accredited capitalist regulations. Furthermore, a person that holds a position like a basic collaboration, executive policeman, or director in the issuing company qualifies as an approved capitalist, additional broadening the interpretation.

The accredited capitalist condition is generally legitimate for one year or until the next tax obligation day if verified via income. Keep in mind there is no federal verification procedure, so it's up to the financial investment provider to execute specific verifications of income and total assets. Being an accredited capitalist features legal obligations and ramifications.

While it uses the capacity for higher returns and more varied financial investments, it can lug higher risks. An accredited financier is usually a high-net-worth individual or entity with substantial earnings and internet well worth, as outlined in Rule 501 of Policy D.

Although these investments tend to be riskier and more illiquidExtra these asset classes can courses advantages use benefits greater diversification better public markets, potentially higher possiblyGreater and exposure to direct exposure or sectors that aren't available in the United States. In this article, we unbox these capitalist statuses for tax payers in the United States and clarify what they can get accessibility to.

For an expanding variety of financiers who certify as an approved financier, financial investment options grow considerably. These investments are suggested to be excluded from SEC enrollment, so there is no official procedure for verifying standing. Each company has its own method for showing certification and it's generally a variation of offering individual information and documentation.

We expect bringing the wealth-building opportunities that were traditionally readily available to the ultra-wealthy to a lot more people. With this first step, we're functioning to make Arta readily available to extra investor kinds and countries in the future. If you want access to wealth-building chances like personal investments, you can get started by becoming an Arta participant today.

Investor Accreditation Verification

Please call us if you have questions concerning the new interpretations of "accredited financier" or "certified institutional buyer" or any kind of other private or public safety and securities issues. The changes are anticipated to end up being reliable by the beginning of November 2020.

Any kind of economic estimates or returns revealed on the site are approximated forecasts of efficiency just, are hypothetical, are not based on real investment outcomes and are not assurances of future results. Approximated projections do not stand for or ensure the actual results of any type of transaction, and no representation is made that any type of purchase will, or is likely to, accomplish outcomes or profits comparable to those revealed.

Accredited Investor Rule 501

Any financial investment info included herein has been secured from sources that Yieldstreet thinks are dependable, yet we make no representations or guarantees as to the accuracy of such information and approve no responsibility. Private positioning investments are NOT bank deposits (and thus NOT insured by the FDIC or by any type of other federal governmental company), are NOT guaranteed by Yieldstreet or any kind of various other celebration, and MAY decline.

Capitalists must have the ability to pay for the loss of their entire investment. Investments secretive placements are speculative and entail a high degree of risk and those capitalists that can not manage to lose their whole financial investment should not spend. Furthermore, capitalists might receive illiquid and/or restricted securities that may undergo holding duration demands and/or liquidity concerns.

Buying protections (the "Securities") provided on Yieldstreet posture threats, including but not limited to debt risk, rate of interest risk, and the risk of losing some or all of the cash you invest. Prior to spending you need to: (1) conduct your very own examination and analysis; (2) carefully consider the financial investment and all relevant costs, costs, uncertainties and risks, including all unpredictabilities and threats explained in providing products; and (3) consult with your very own investment, tax, economic and legal experts.

Becoming An Investor

Purchasing private placements requires long-term commitments, the capability to afford to lose the whole investment, and reduced liquidity needs - qualified investor definition. This site supplies preliminary and general information regarding the Stocks and is planned for initial recommendation purposes just. It does not summarize or put together all the relevant info. This website does not constitute a deal to offer or purchase any type of safeties.

Yieldstreet does not make any type of depiction or service warranty to any kind of prospective financier regarding the legitimacy of a financial investment in any Yieldstreet Stocks. YieldStreet Inc. is the straight owner of Yieldstreet Management, LLC, which is an SEC-registered financial investment consultant that manages the Yieldstreet funds and gives financial investment recommendations to the Yieldstreet funds, and in specific situations, to retail capitalists.

We then make use of an additional company to send out special deals through the mail on our behalf (sec sophisticated investor definition). Our business never receives or stores any one of this information and our 3rd events do not give or sell this information to any kind of various other business or service

Latest Posts

Tax Sales Property Auction

The Truth About Tax Lien Investing

Investing In Tax Lien